People are living longer than ever before. That means they have many more years to enjoy a well-earned retirement in the beautiful communities of our coastal area.

However, longer lifespans make it critical to carefully manage risk – even after retirement – to ensure retirees have the funds they need to maintain their lifestyle.

These are seven ways retirees can protect their retirement income from perils like inflation, market volatility and outliving their savings.

Keep emotions in check. Every dollar put away for retirement years represents hard work. Because of this, many people have strong emotional reactions to dips in the market. They are tempted to protect their funds by reacting to short-term trends instead of sticking to a long-term investment strategy. The best thing to do to manage this risk is to keep an eye on personal goals, and ignore the daily ups and downs.

Beware of overspending. There are a lot of factors that go into calculating how long retirement money will last, including current age, life expectancy, current rates of return and the amount saved. A financial advisor can help by giving individual retirees an approximate figure they can safely withdraw each year without putting themselves at risk of running out of money.

Design a portfolio with inflation in mind. One of the most frustrating things about setting money aside is that over time, buying power is eroded by inflation. When it comes to retirement, this issue goes from discouraging to dangerous, as inflation can dramatically decrease the value of a portfolio. It’s important for retirees to use tried-and-true, inflation-proof portfolio management techniques to ensure their rate of return will, at a minimum, keep up with the cost of maintaining their preferred lifestyle.

Focus on interest rates. At one time, interest rates of 5 percent or more were standard. That made it simple to accumulate solid earnings, and interest income could be relied upon for living expenses after retirement. However, those high rates have been gone for a long time now, and future rates are uncertain. In the interim, it is important to adjust a portfolio to account for low interest rates, and ensure there are sufficient funds invested in holdings to generate better returns.

Plan for longevity. Most people assume their lifespans will be far shorter than statistics indicate, and they plan for their retirement accordingly. Unfortunately, the result is that many retirees outlive their savings. The best way to mitigate this risk is to assume a best-case scenario for retirement planning purposes. Save, invest and spend like someone who will live to be 100 years old. (And enjoy the health benefits of living in our thriving, active communities.)

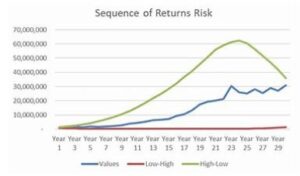

Prepare for market changes. The economy goes through regular cycles, and no matter how carefully retirees invest, they are sure to be faced with a market downturn at some point. This isn’t an issue while they are still making contributions to retirement accounts, but it can add complexity during the distribution phase. Over time, with no withdrawals, their investments may recover, but this can take years. And avoiding all withdrawals during this period isn’t practical, so their overall income strategy must take downturns into consideration when calculating annual distribution targets.

Focus on the sequence of returns. Market changes include the probable consequence of having to make withdrawals during a market downturn, which goes against the standard “buy low, sell high” investment wisdom. If this happens early in retirement, depletion of savings can add up quickly. Decisions on when to retire, how much to withdraw and when to begin distributions must be made with these possibilities and risks in mind.

While planning ahead is essential, so is having good guidance from an expert financial advisor with a fiduciary commitment to clients’ best interests.

Retirees Can Learn to Minimize Risk, Cape Gazette